- PER CONTATTARCI

- +39 0461-816036

- info@chindet.it

Brokers With Synthetic Indices Which Broker Has Synthetic Indices?

20bet Bónuszok 100% Üdvözlő Bónusz És Bónuszkódo

30 Marzo 2023Можно Ли Найти Работу В It После Forty Лет Хабр

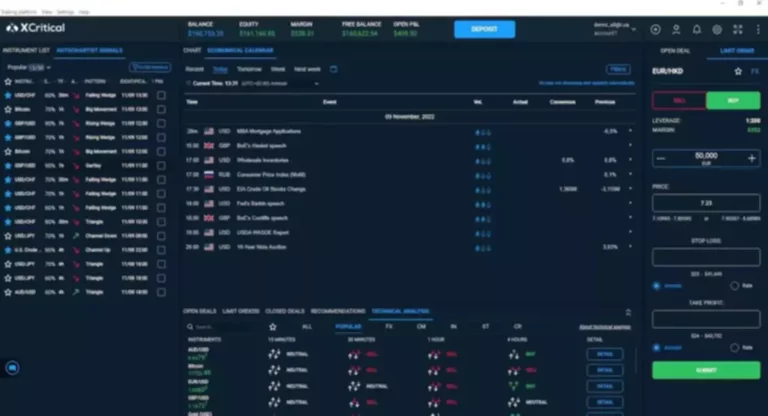

1 Aprile 2023This article explains how you can easily confirm your Deriv account after you create Deriv real account. This is the currency that you’ll use to commerce, deposit and withdraw. Make certain you choose the best currency as you will be synthetic index unable to change this after you’ve made a deposit. First, you should create Deriv real account by clicking the button beneath. They would promptly suspend the broker from working in their jurisdictions.

Before you determine on methods to commerce artificial indices, you first need to grasp why you would trade synthetic indices at all. Therefore, any dealer that can get real-time quotes of the forex and inventory markets can simply present them for buying and selling to their shoppers. Synthetic indices can be found to commerce 24/7, have constant volatility and stuck generation intervals, and are freed from the market and liquidity risks.

Ensure that the dealer is allowed and regulated by a recognized financial authority. Verify that the broker offers entry to a broad range of Synthetic Indices, allowing you to choose from numerous markets and instruments. Although they’re unpredictable devices, merchants are conscious of the dangers of trading artificial indices from the beginning.

Tips On How To Commerce Artificial Indices

This Deriv demo account is meant that will assist you get used to the platform and check out strategies etc. In the Volatility 10 Index, the volatility is saved at 10%, which is a wonderful alternative for merchants who prefer low worth swings or fluctuations. With the Volatility one hundred index, the volatility is maintained at 100%, meaning there are a lot stronger price swings and no significant value gaps.

Matching trading persona with the appropriate strategy will ultimately permit traders to take the first step in the best direction. In the CFD and binary choices house, there are also some synthetic indices brokers with bonus schemes. But whereas deposit bonuses can be engaging, make sure you perceive any withdrawal terms earlier than opting in.

All info on The Forex Geek web site is for academic purposes only and is not supposed to offer monetary recommendation. Any statements about earnings or earnings, expressed or implied, don’t characterize a assure. Your actual buying and selling might lead to losses as no buying and selling system is assured. Self-confessed Forex Geek spending my days researching and testing every little thing foreign exchange associated.

Where To Trade Artificial Indices

Yes, some brokers with synthetic indices provide buying and selling on MetaTrader four (MT4) and MetaTrader 5 (MT5). However, conventional stocks, futures and options brokers typically draw back from the much less clear natures of simulated artificial indices. The charges and commissions paid when buying and selling synthetic indices are often dependent on the vehicle and broker somewhat than the kind of index.

We’re dedicated to supplying you with the perfect in investing schooling with a give consideration to detailed guides in complicated financial subjects, trading, economics and personal finance. Deriv X, Deriv Bot, and options buying and selling aren’t out there for shoppers residing throughout the EU. On Deriv, you can commerce CFDs with high leverage, enabling you to pay only a fraction of the contract’s value. The best technique is using trendlines to try and catch swings available within the market. Boom and Crash have turn out to be very fashionable with plenty of videos on YouTube talking about tips on how to catch BOOMS AND CRASHES on this market.

Which Broker Presents Synthetic Indices?

To do the Deriv actual account registration you’ll need to do Deriv.com login into the Deriv demo account you created in the step above. This is rather like in real-world monetary markets the place the broker has no affect on the value actions. At the moment, there is solely one artificial indices broker that gives these trading devices on different trading platforms. Deriv is a pioneer and market chief in trading with over 20 years of experience and multiple awards. Synthetic indices are a kind of unique buying and selling instruments that are simulated to reflect or mimic (copy) the behaviour of real-world financial markets. Deriv GO is Deriv’s mobile app that’s optimised for on-the-go buying and selling.

With the exclusion of basic news, synthetic indices are specifically created to copy the real-world market. As a result, the perfect time to trade artificial indices isn’t a matter of time or day. In this text, we might be discussing tips on how to trade synthetic indices efficiently as an expert trader. With binary choices, there are not any trading fees, with profits dictated by payouts. While traders should shop round for the most aggressive payouts, guarantee that you are not enticed right into a suspect dealer by excessive payouts alone.

Deriv’s proprietary synthetics simulate real-world market actions. Synthetic indices are unique indices that mimic real-world market motion however with a twist — they aren’t affected by real-world events. Synthetic indices are buying and selling products that typically derive their value from random number generators and sophisticated algorithms. For asset-based synthetic indices, this can mean finding brokers that support merchandise from a spread of economic markets, corresponding to stocks and forex.

If you start by trying to focus on all of them will depart you distracted. The Boom 500 index has on average 1 spike within the price sequence each 500 ticks while the Boom a thousand index has on average 1 spike in the value series every a thousand ticks. The first option beneath the Real tab will be the option to create a real Deriv account.

- A third-party audit is performed earlier than the software predicts the subsequent market movement to ensure there is transparency between the broker and the merchants.

- Now, let’s take a extra in-depth look at how this offers merchants more flexibility and opportunity.

- After creating the Deriv real account mt5 you’ll now see the account listed together with your login ID.

- Additionally, you’ll be able to discover external instructional materials, attend workshops, and take part in buying and selling communities to increase your information.

The Volatility 100 index maintains volatility at one hundred pc, leading to considerably larger value swings and no discernible worth gaps. Although artificial indices have their benefits, in addition they include their very own set of disadvantages as nicely. The bounce indices measure the worth jumps of an index with an assigned uniform volatility share per hour.

Simulated Artificial Indices

You can also do Deriv signup for an artificial indices account utilizing Facebook, Gmail and your Apple Id by clicking on any of the buttons below the signup web page. After completing this step you’ll have created a Deriv demo account. This is because Deriv provides a wide range of completely different trading instruments together with foreign exchange currencies, cryptocurrencies, shares, commodities and, of course, artificial indices. The random quantity generator can be frequently audited for fairness by an impartial third get together to make sure fairness. This ensures that the broker just isn’t disadvantaging traders by manipulating the volatility/synthetic indices. The charts and indicators are customisable based on your buying and selling strategy.

Synthetic indices offer a special buying and selling experience that you can take advantage of. With as low as $10, you can start trading and build your portfolio to whatever amount you want. This is the forex that you will use to trade, deposit, and withdraw. However, to commerce actual money you will have to open a ‘Real’ account.

Synthetic indices transfer through random numbers generated by an algorithm. For transparency issues, the dealer is unable to influence or predict which numbers might be generated. Synthetic indices are available to commerce 24/7, have fixed volatility and stuck era intervals. Stock markets, for example, move in response to the value movement of the stock. The similar occurs in forex markets where the forex chart strikes up and down in response to the price of the forex pair.